All Categories

Featured

Table of Contents

Mean there is a specific whose income was $150,000 for the last three years. They reported a key residence worth of $1 million (with a home mortgage of $200,000), a car worth $100,000 (with a superior lending of $50,000), a 401(k) account with $500,000, and a financial savings account with $450,000.

Total assets is determined as properties minus liabilities. He or she's web worth is specifically $1 million. This involves a calculation of their properties (aside from their primary residence) of $1,050,000 ($100,000 + $500,000 + $450,000) much less a cars and truck loan equaling $50,000. Because they fulfill the total assets demand, they qualify to be a certified capitalist.

Professional Private Investments For Accredited Investors – Cincinnati

There are a few much less usual certifications, such as managing a count on with even more than $5 million in possessions. Under federal securities legislations, only those who are accredited investors may take part in certain safeties offerings. These may consist of shares in private positionings, structured products, and exclusive equity or hedge funds, among others.

The regulatory authorities want to be particular that participants in these very high-risk and complicated financial investments can take care of themselves and judge the threats in the lack of government security. growth opportunities for accredited investors. The certified capitalist regulations are developed to secure potential financiers with limited monetary knowledge from adventures and losses they may be sick outfitted to hold up against

Please assess North Resources's and its background on. Investments secretive offerings are speculative, illiquid and involve a high degree of threat and those investors who can not afford to shed their entire investment and who can not hold a financial investment for an indeterminate period should not purchase such offerings.

Innovative Investments For Accredited Investors Near Me (Cincinnati 45201 OH)

All details supplied herein should not be depended upon to make an investment choice and does not plan to make an offer or solicitation for the sale or acquisition of any type of certain safeties, investments, or investment methods.

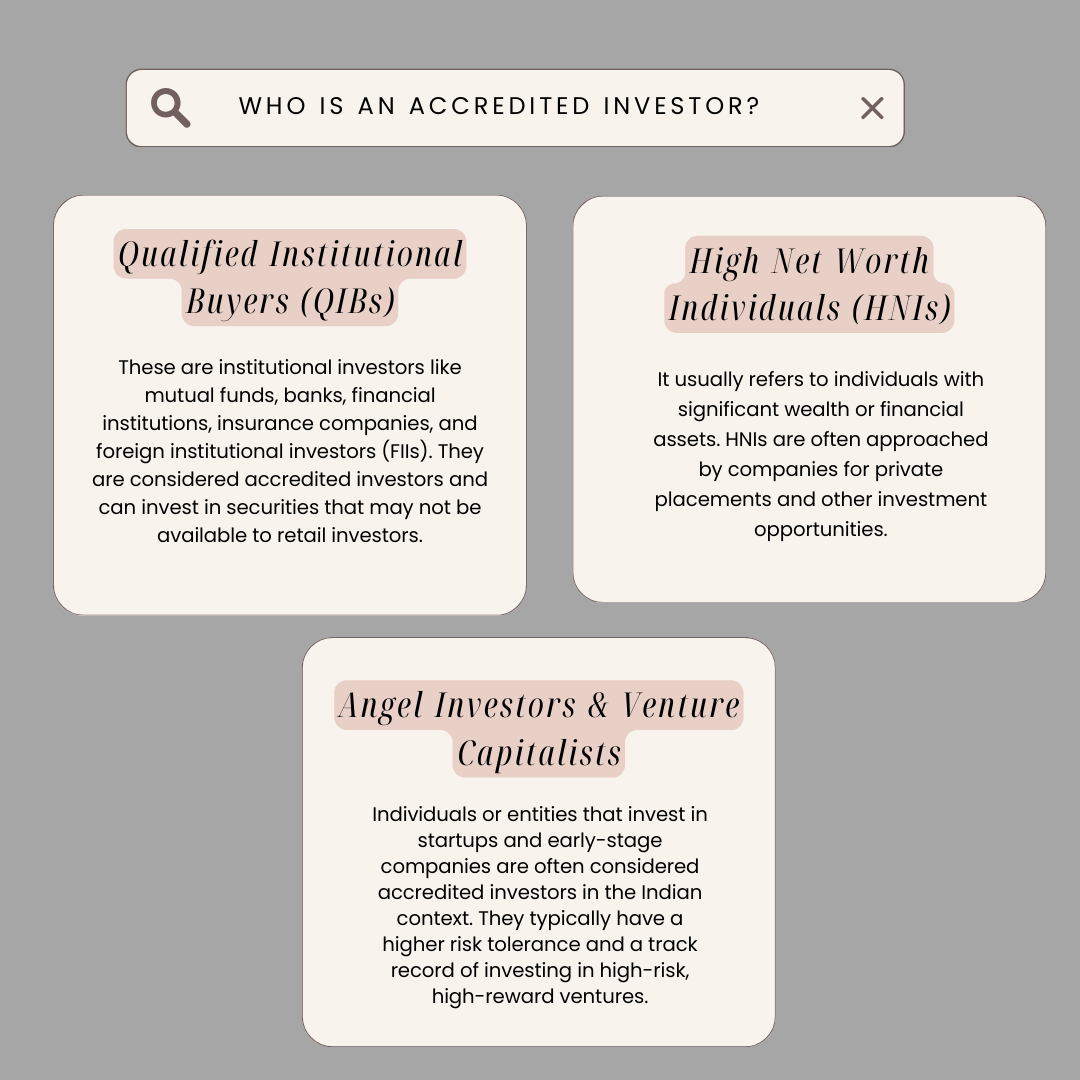

Certified financiers play a fundamental function in the specific area of private positionings. This term, controlled by the Stocks and Exchange Commission (SEC), details who can involve in these considerable yet non-public investment opportunities. It is vital to understand who certifies as an accredited capitalist, their relevance secretive positionings, and the impact of recently revised meanings on the financial investment arena for capitalists and issuers.

To qualify, an investor has to have earned much more than $200,000 each year (or $300,000 with a partner) in the last two years, or they must have a net well worth exceeding $1 million, individually or collectively with a partner, not counting the value of their key home. These standards make certain that capitalists have actually the required economic acumen or safeguards to take care of the dangers linked with these investments.

Affordable Best Opportunities For Accredited Investors Near Me

Therefore, approved capitalists are vital for these deals, providing services the chance to safeguard the required funding with less limitations. The more comprehensive meaning of accredited financiers has substantial implications for the exclusive placement market: This growth consists of professionals with relevant credentials, considerably widening the pool of possible capitalists.

As the SEC updates the interpretation of an accredited financier, it's important to recognize how these adjustments influence investors and issuers alike. These alterations influence that is eligible to buy private positionings and have more comprehensive ramifications for funding and technology within the economy. Expanding the certified financier criteria will introduce much more chances, increase diversity, and bolster the strength of the personal funding markets.

Effective 506c Investment – Cincinnati

It's one point to make cash; it's fairly another holding onto it and, certainly, doing what's needed to make it grow. The field has many verticals covering traditional asset courses like equities, bonds, REITs and common funds.

Certified capitalists have an one-of-a-kind benefit in the financial investment landscape, holding the secrets to a larger choice of possibilities that have the potential for significant rois (ROI). For those that have actually recently achieved this accreditation or are seeking it, there is a fundamental ideology to realize here - real estate crowdfunding accredited investors. Making this gain access to is not just a ticket to elite investment circles however a contact us to tactical preparation and astute decision-making

To that end, we'll provide you with a deeper understanding of what it means to be a certified financier and some suggestions on exactly how to take advantage of that gain access to for your best returns. Coming to be an accredited investor indicates the doors are now available to a brand-new globe of even more complex investment options.

These financial investments must just be taken care of by knowledgeable investors that are skilled in a minimum of the fundamentals of how they work and exactly how they behave. More financial investment choices suggest you likewise have more options for diversity. This is just one of the most usual methods to handle dangerexpanding your investments across different property classes.

Effective Hedge Funds For Accredited Investors Near Me

Prior to signing on the dotted line, discuss your research study once more and make sure you understand the investment possibilities available to you. Think about looking for economic specialists who agree to impart recommendations regarding whether you're making a knowledgeable decision (accredited crowdfunding). It deserves highlighting that many accredited financial investments entail even more speculation and greater risks

Approved investors have the advantage of accessing much more complicated financial investments past the reach of traditional markets. A great saying to maintain in mind is that the more complicated the financial investment, the extra innovative your strategy must be. These could consist of: Ventures right into private equity, where financiers can take significant risks in exclusive firms Forays into hedge fundsknown for their aggressive strategies and prospective for high returns Direct investments in genuine estate, offering substantial assets with capacity for recognition and revenue A lot more robust strategies are required below to reduce the inherent threats such as illiquidity, greater volatility, and intricate regulatory requirements.

Recognized investors involving in complex financial investment techniques have a side impact of the demand for an extra intricate tax strategy to go along with it. You can purchase a property and get rewarded for holding onto it. Approved investors have much more possibilities than retail financiers with high-yield investments and beyond.

Value Accredited Property Investment Near Me

You should meet at the very least among the following specifications to come to be an accredited capitalist: You need to have over $1 million total assets, excluding your key home. Company entities count as accredited financiers if they have over $5 million in assets under administration. You must have an annual earnings that surpasses $200,000/ yr ($300,000/ year for companions submitting with each other) You should be a registered investment consultant or broker.

Table of Contents

Latest Posts

Property Tax Sale List

Back Tax Land For Sale

Tax Foreclosure List

More

Latest Posts

Property Tax Sale List

Back Tax Land For Sale

Tax Foreclosure List